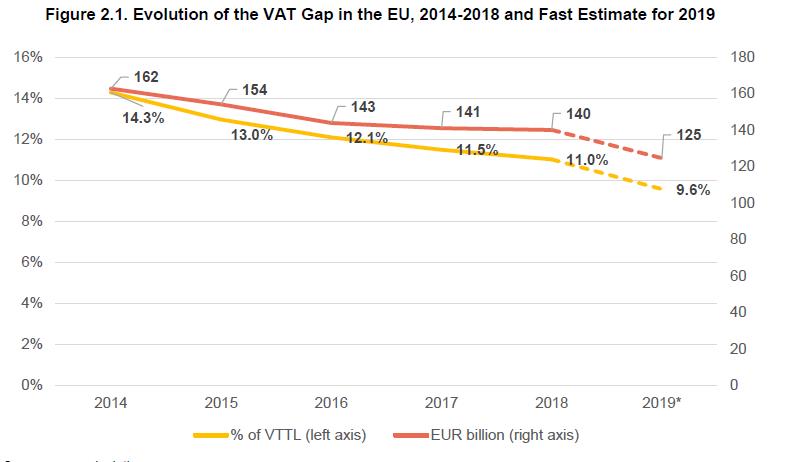

Alternative method to measure the VAT gap in the EU: Stochastic tax frontier model approach | PLOS ONE

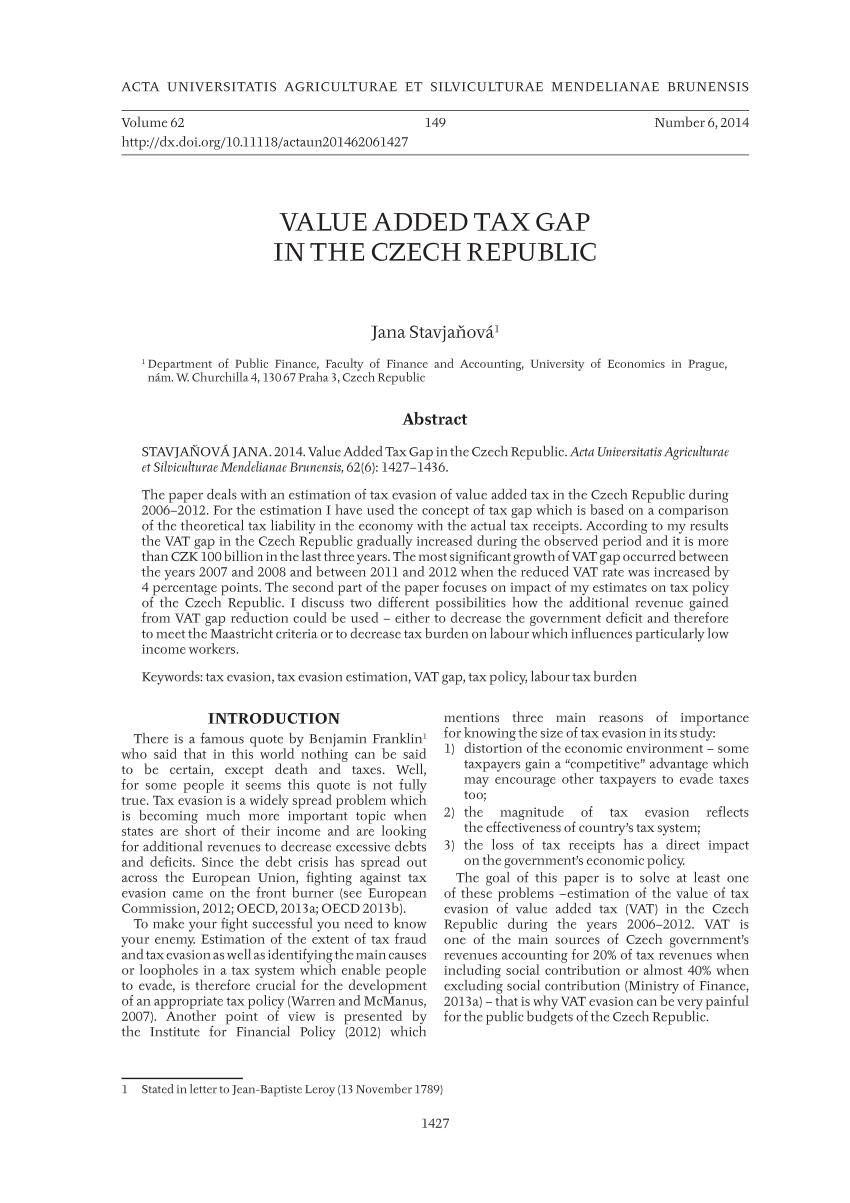

Czech Republic: Staff Report for the 2013 Article IV Consultation in: IMF Staff Country Reports Volume 2013 Issue 242 (2013)

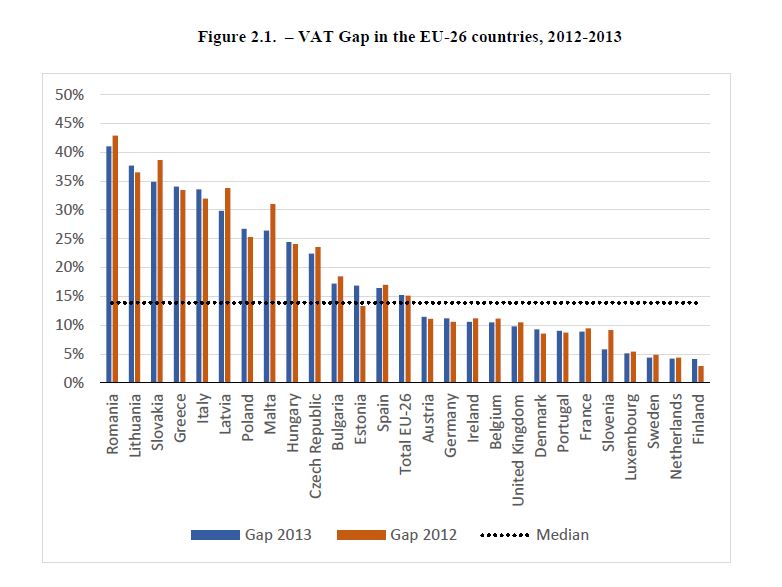

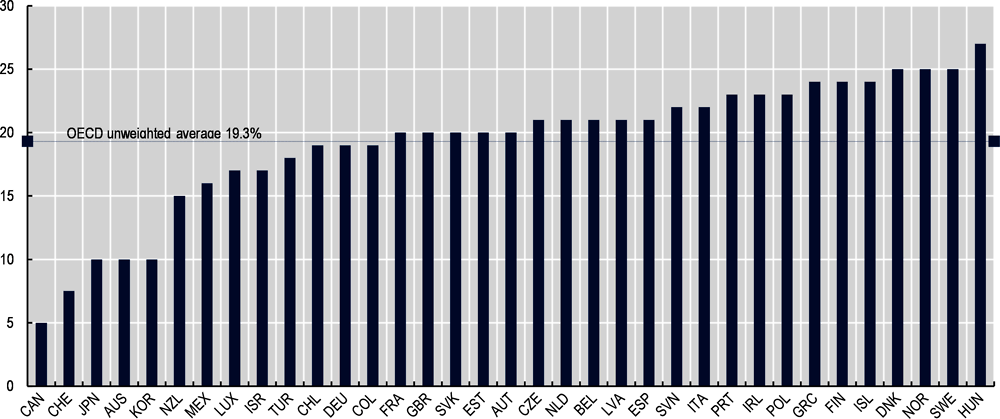

VAT gap in the EU-27 in 2014 (% VTTL). Source: TAXUD/2015/CC/131, 2016,... | Download Scientific Diagram