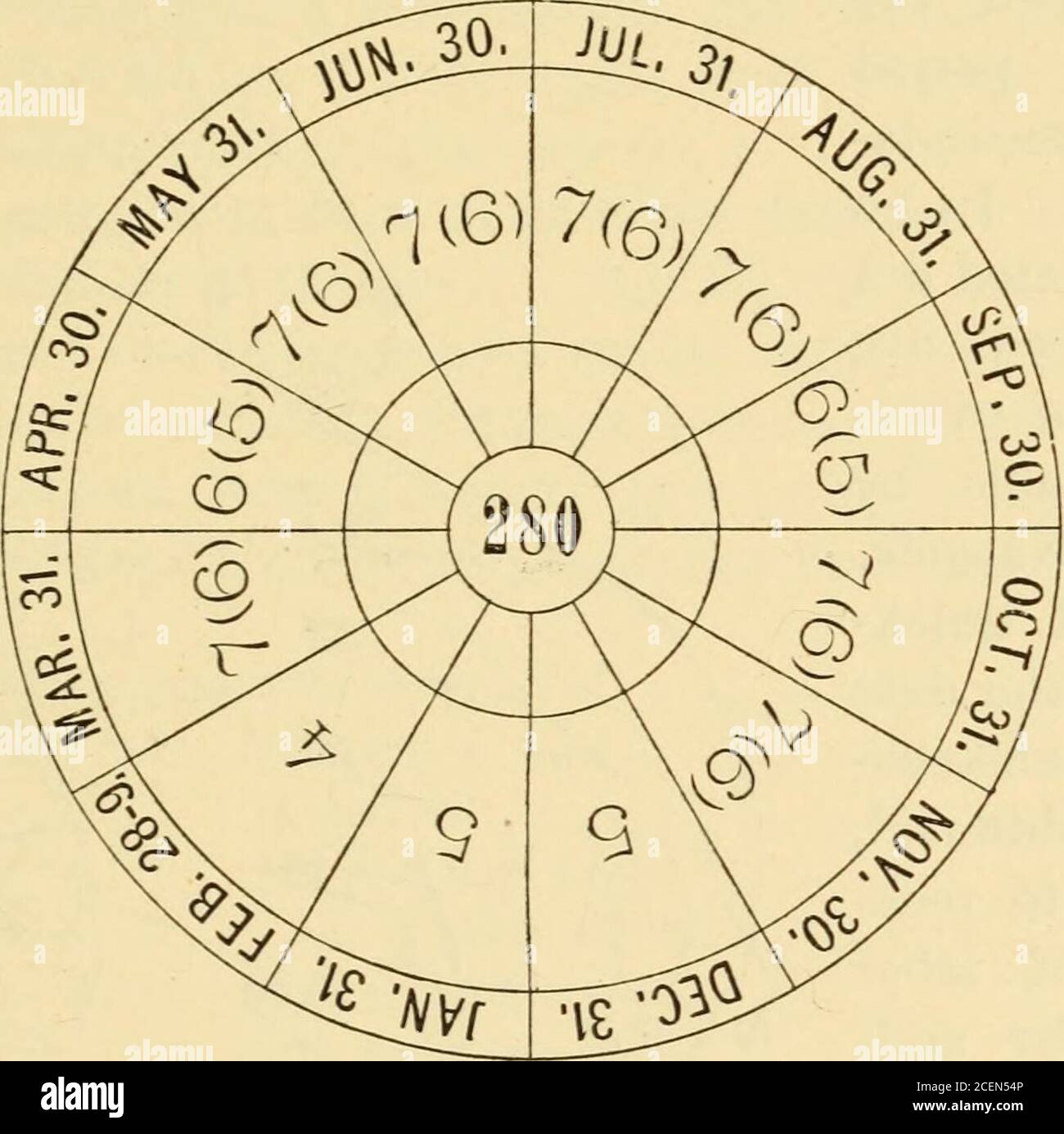

The science and art of midwifery. given date, which has since his time been generallyadopted. This consisted in counting forward nine months, or, whatamounted to the same thing, counting backward three

Fillable Online CIT 0407 E : How to Calculate Physical Presence - Immigroup Fax Email Print - pdfFiller